Bank Of Canada Prime Rate

2009 Longest period of no change. Not for US dollar loans in Canada.

Banks Simple Financial Analysis

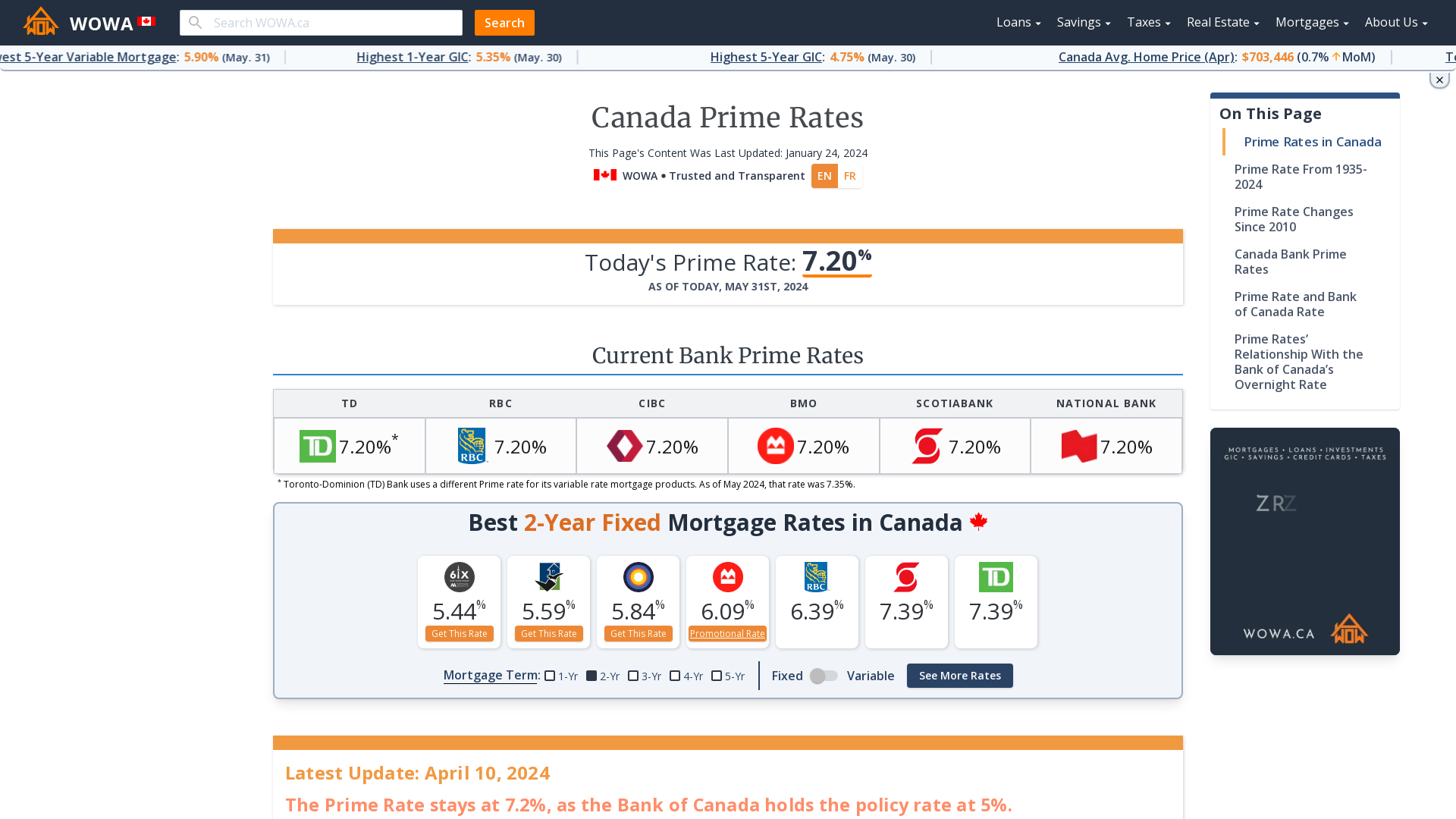

RBC Royal Banks prime rate is currently 245.

Bank of canada prime rate. The prime rate is the lending rate Canadas banks and financial institutions use to set interest rates for variable loans and lines of credit including mortgages. RBC Royal Bank Prime Rate. Prime Rate Advertising Disclosure.

The RBC Royal Bank prime rate is 245. RBC Royal Bank Prime Rate Advertising Disclosure. The Bank of Canada keeps overnight rate at effective lower bound and maintains QE program.

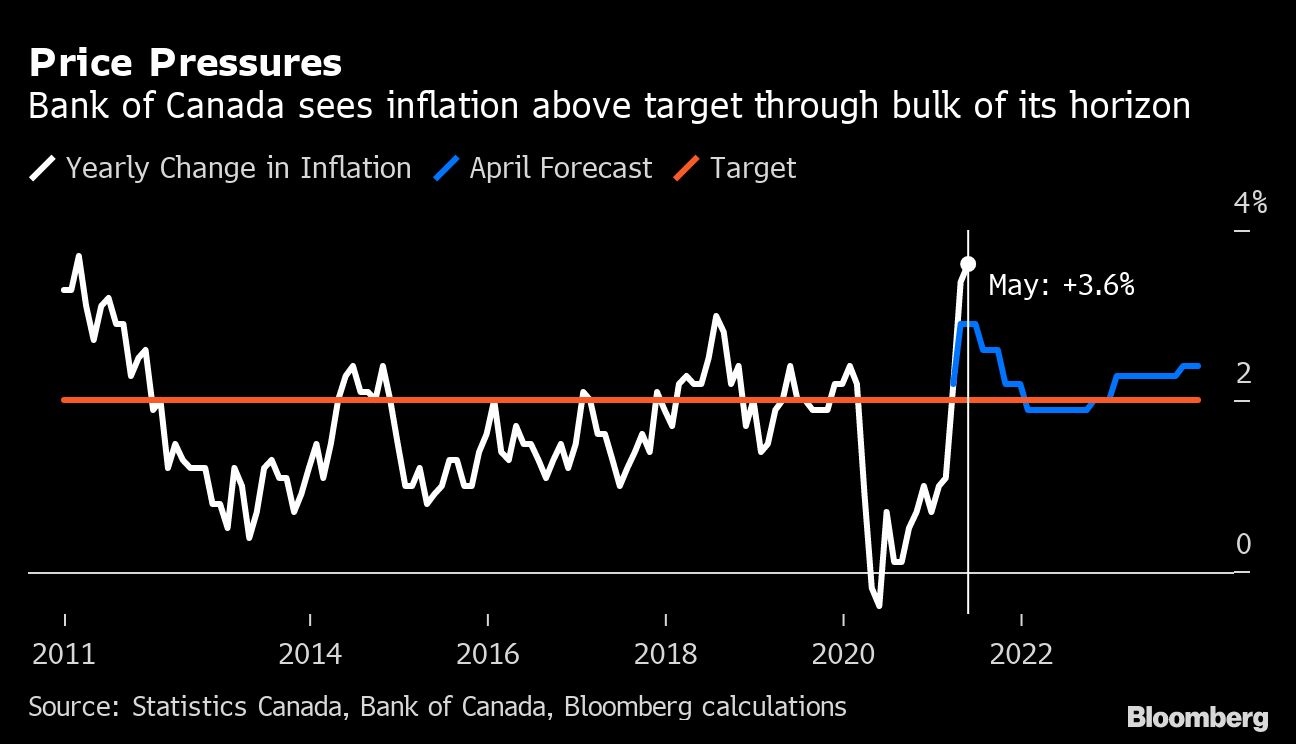

The Bank of Canada delivered welcome news for variable-rate mortgage holders today when it stood by its expectation of no rate hikes until early 2023. We are not a commercial bank and do not offer banking services to the public. 60 chance of one hike in next 12 months BoCs Headline Quote.

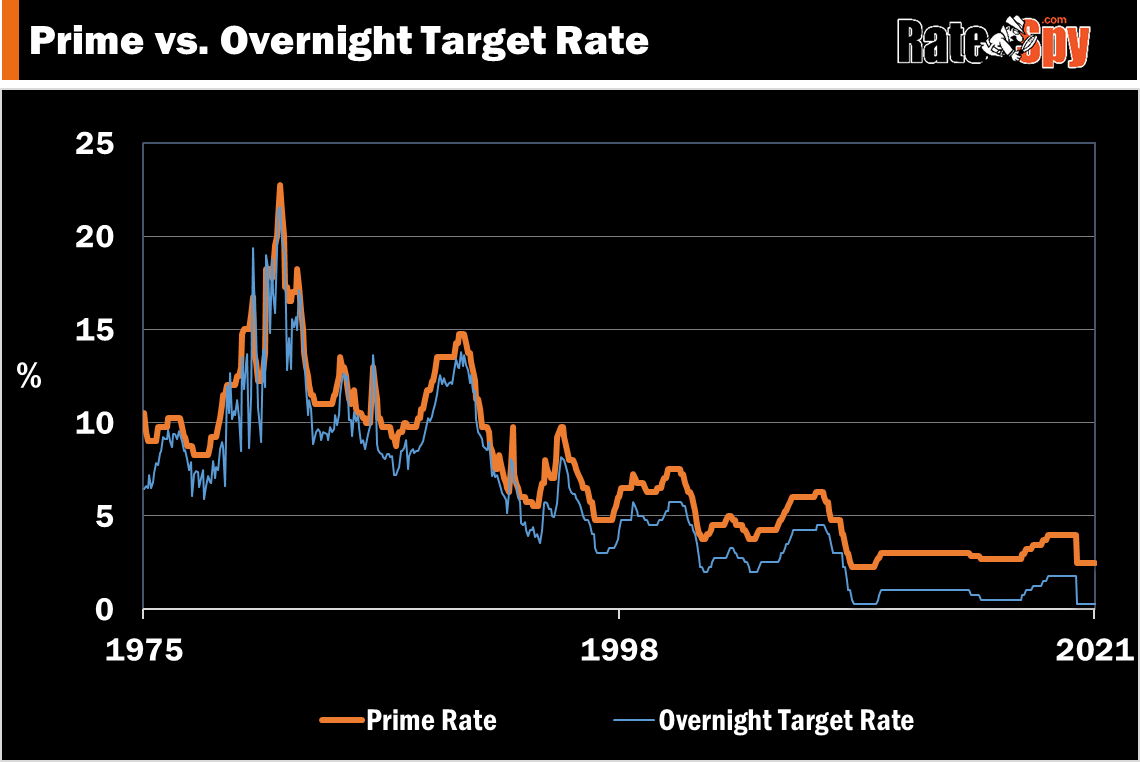

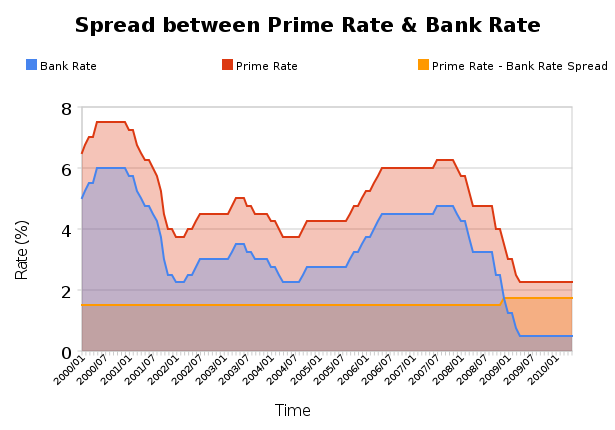

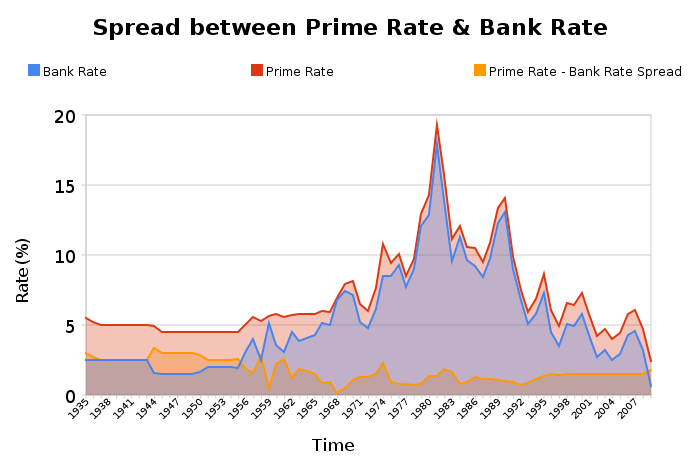

Each financial institution sets its own prime rate as a function of its cost of funding which in turn is influenced by the target for the overnight rate set by the Bank of Canada. Bank Lending Rate in Canada remained unchanged at 245 percent in October from 245 percent in September of 2021. We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved reads the BoC statement released following its rate.

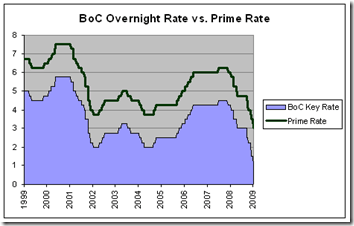

Canadian Interest Rate Forecast to 2023. Despite increasing asset prices with the SPTSX Composite index growing 19 in 2019 and stable global economic growth pressures from Canadas lagging energy sector and uncertain trade relationships with US and China created a headwind to further tightening of. All of Canadas main banks and financial institutions use the prime rate also called the prime lending rate as the annual interest rate.

Rates for 02 October 2021. Rather we have responsibilities for Canadas monetary policy bank notes financial system and funds management. This is lower than the long term average of 785.

About RBC Royal Banks prime rate. The Bank reiterated that the interest rate would remain at its effective lower bound until economic slack is. Long-term government bond rates have risen from 03 to 10 since January.

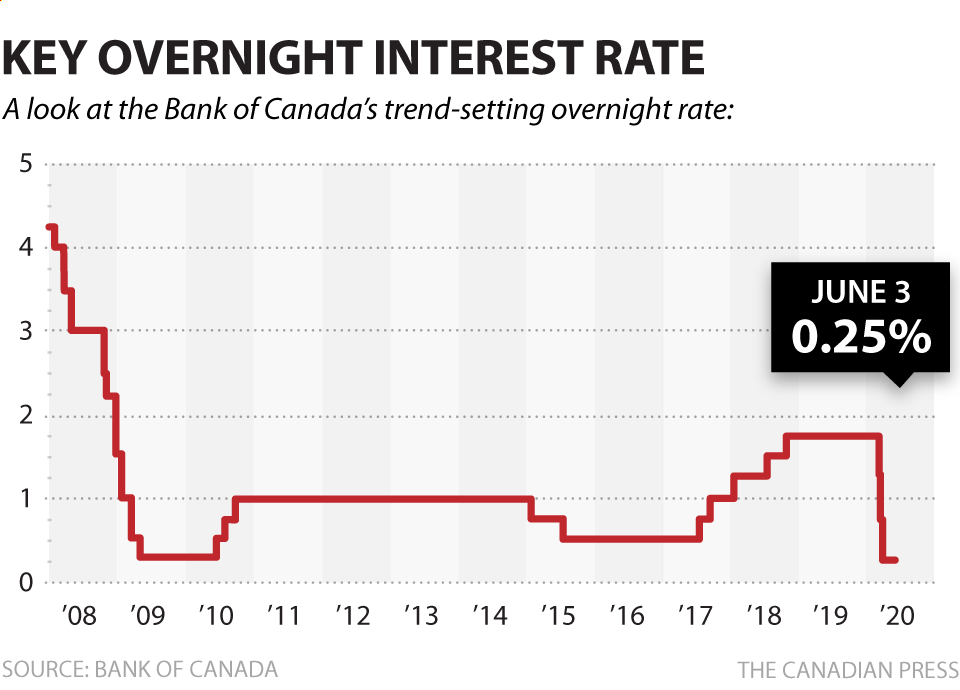

The Bank of Canada BoC opted to keep the overnight rate at 025 while also maintaining the quantitative easing QE program to at least 2 billion of asset purchases per week. Royal Bank of Canada Prime Rate means the rate of interest expressed as a percentage per annum published and quoted by Royal Bank of Canada s Toronto Ontario Head Office and which is commonly known as the prime lending rate for commercial loans in Canadian Dollars. See Prime Rate Market Rate Forecast.

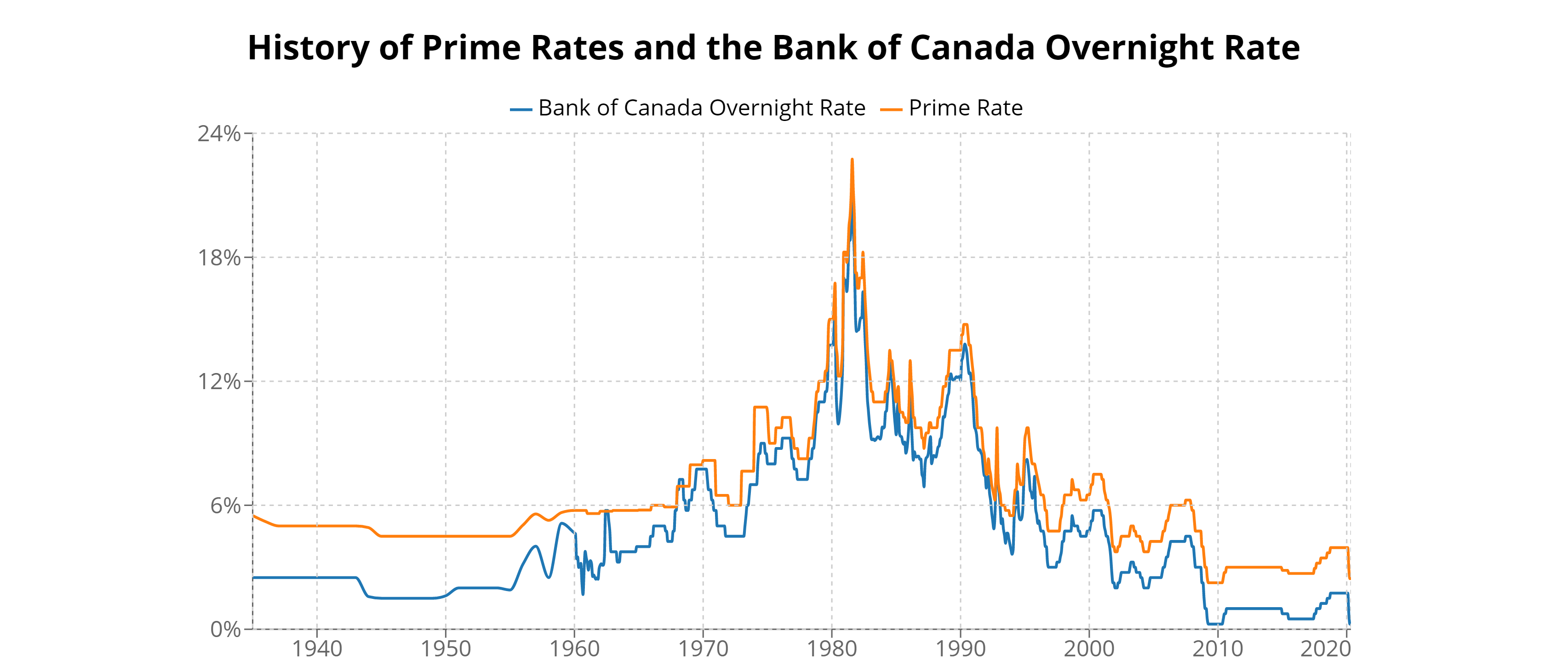

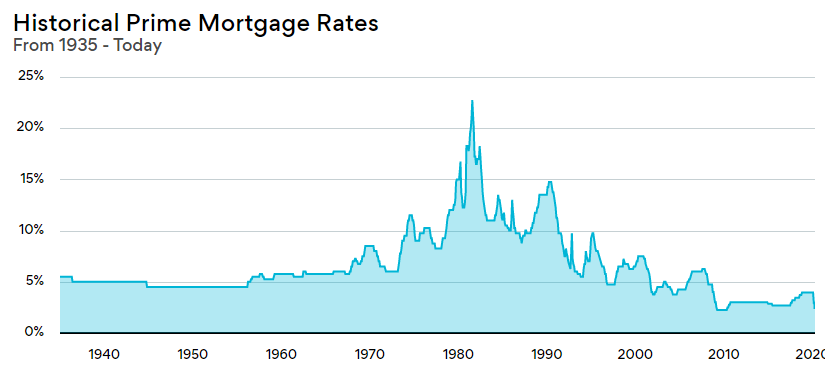

Bank Lending Rate in Canada averaged 711 percent from 1960 until 2021 reaching an all time high of 2275 percent in August of 1981 and a record low of 225 percent in April of 2009. USD Deposit Reference rate. The decrease in the Bank of Canada rate.

CAD Deposit Reference rate. The prime rate in Canada is currently 245. The prime rate or prime lending rate is the interest rate a financial institution uses as a base to determine interest rates for loan products.

Our principal role as defined in the Bank of Canada Act is to promote the economic and financial welfare of Canada. Notes Interest rates are subject to change without notice at any time. The TD Bank prime rate is 245.

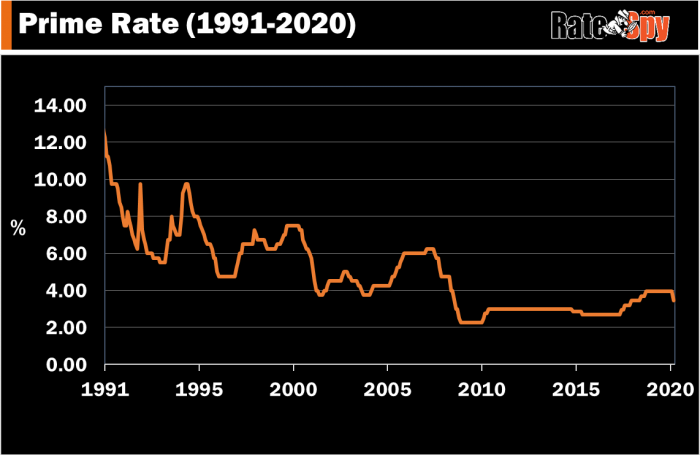

Canadas Prime rate in 2019 remained stable at 395 as the Bank of Canada maintained its target overnight rate at 175. Canada Prime Rate is at 245 compared to 245 last week and 245 last year. Canada Bank Prime Rates.

Royal Bank US Prime. The prime interest rate fell from its previous level of 395 as the bank of Canada accelerated cuts to its overnight rate in order to boost the economy and minimize the financial impact of the pandemic. Major Canadian banks tend to set their own prime rate alongside the Bank of Canadas target for the overnight rate but in theory they could adjust their prime rate if they saw fit.

Annual interest rates on our Credit Card products. No change to rates Overnight rate. The Bank of Canada is the nations central bank.

The Bank of Canada rate not officially the target overnight rate until much later in the century started at 25 in 1935 and ended at 15 in 1945. This page provides - Canada Prime Lending Rate - actual values historical data forecast chart. Based on the Banks latest projection policy rate increases are now expected to happen sometime in the second half of 2022 BoC on the Economy.

Rate Date of Change. Prime and Other Rates. Rates for residential mortgages.

The Scotiabank prime rate is 245. There was also increased employment especially of women. GICs and Term Deposits.

Rates subject to change without notice. This rate influences the interest rates levied on variable loans variable rate mortgages and lines of credit. US Base Rate.

The BoC chief made the comments during a conference call following the Banks interest rate meeting where it left the overnight lending rate unchanged at 025 at its effective lower bound. The prime rate has remained at 245 since it was cut three times in a row in early 2020 when the pandemic first hit Canada. 2015 Since the Bank of Canada started inflation targeting in 1991 the average Bank of Canada rate hike cycle has lasted 229 percentage points as measured from the trough to the peak as of September 2018.

TD Bank Prime Rate. The economy strengthened during the war as Canada played a vital role in supplying natural and manufactured resources to the Allies. Thank you for your patience and understanding.

This has a knock-on effect on mortgage rates which have risen roughly half a percent. At its May announcement the Bank of Canada BoC signalled it might start raising short-term interest rates in late 2022 as a. The prime rate also known as the prime lending rate is the annual interest rate Canadas major banks and financial institutions use to set interest rates for variable loans and lines of credit including variable-rate mortgages.

Prospective homebuyers were reassured today that interest rates will remain near historic lows for a long time according to Bank of Canada Governor Tiff Macklem. The US Prime Rate is equal to the US base rate - 050. Growth in the first.

Bank Of Canada Raises Key Interest Rate And Hints At More To Come

Inflation Overshoot Has Boc Weighing Mandate Tweaks Bnn Bloomberg

Interest Rates Are Going To Go Crazy Soon

Fichier History Of Prime Rates And The Bank Of Canada Target Overnight Rate Png Wikipedia

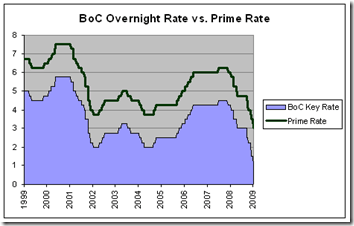

Prime Vs The Bank Of Canada Mortgage Rates Mortgage Broker News In Canada

Prime Rate In Canada 2021 How To Save Money

Bank Of Canada Prime Rate History Sandra Jackson Real Estate Toronto

World Interest Rates The Globe And Mail

One Three Five Year Fixed Mortgage Rate Mortgage Interest Rates Fixed Mortgage Mortgage Rates

Canada S Prime Rate Drops To 3 45 Ratespy Com

Canada Long Term Interest Rate 1993 2021 Ceic Data

Fastest Bank Of Canada Prime Rate History Chart

Prime Rate Spread Simple Financial Analysis

What Is The Prime Rate In Canada Right Now

Canada Prime Rate History 1935 October 2021 Wowa Ca